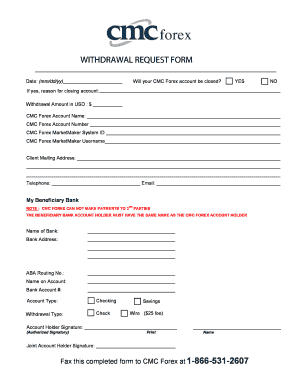

Humboldt State University Lost Receipt Memo free printable template

Show details

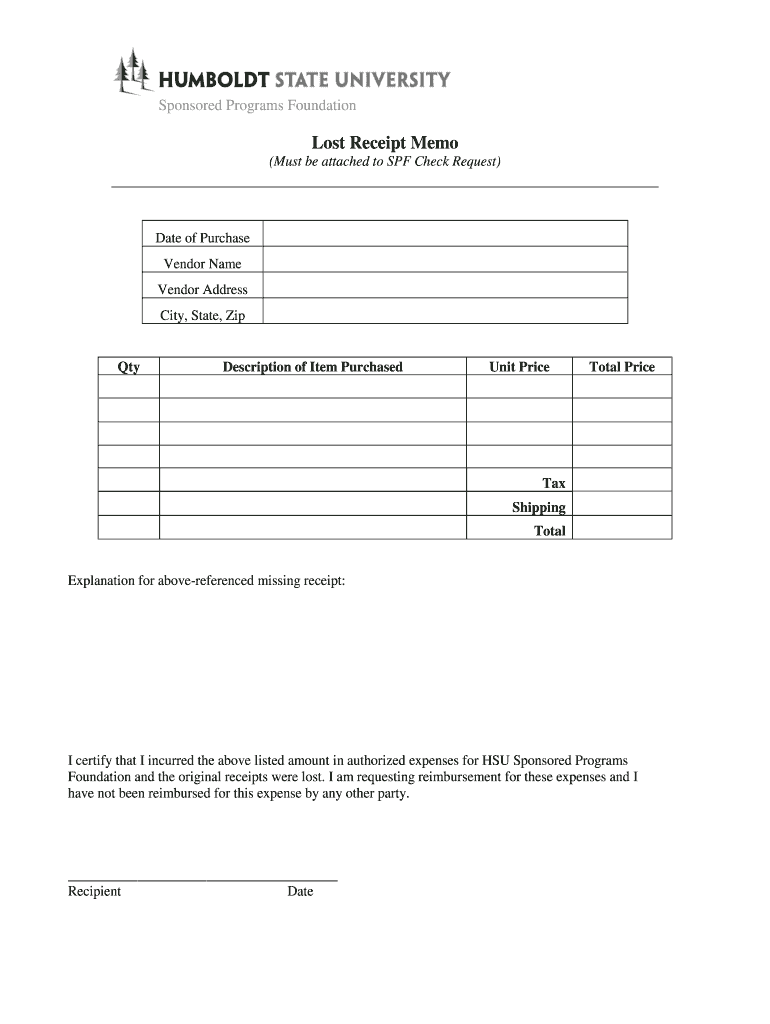

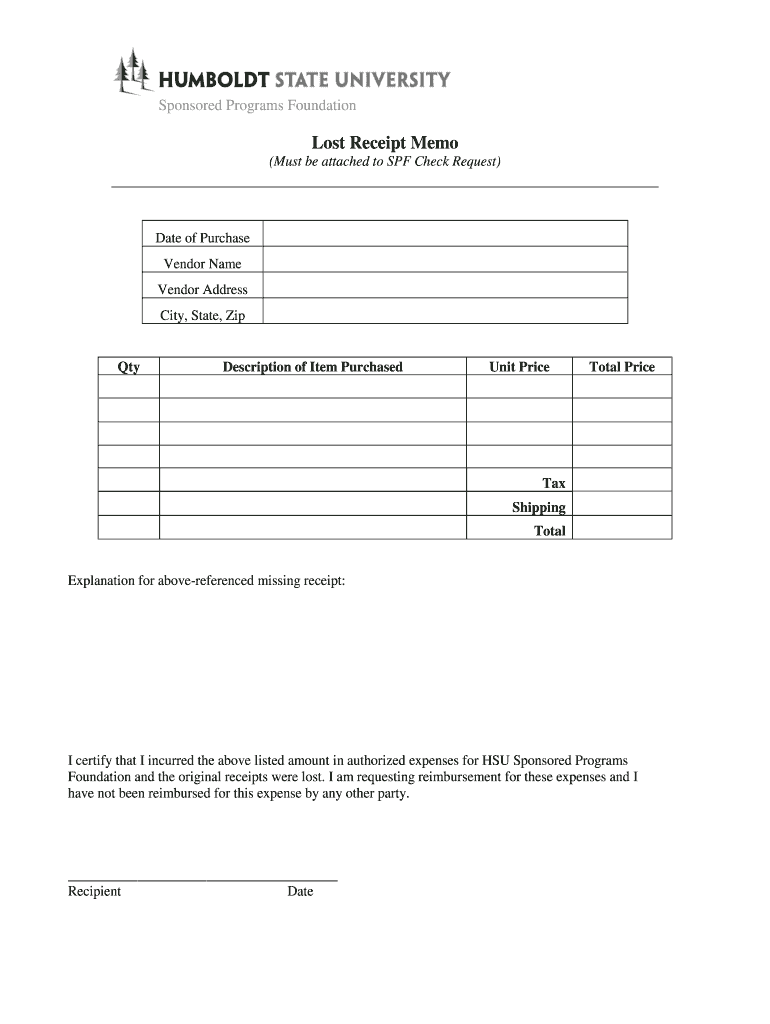

Sponsored Programs Foundation Lost Receipt Memo (Must be attached to SPF Check Request) Date of Purchase Vendor Name Vendor Address City, State, Zip Qty Description of Item Purchased Unit Price Total

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign missing receipt affidavit template form

Edit your missing receipt form template form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your missing receipt affidavit template word form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lost receipt form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit missing receipt template form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out missing receipt form

How to fill out Humboldt State University Lost Receipt Memo

01

Begin by obtaining a copy of the Humboldt State University Lost Receipt Memo form.

02

Fill in your name, department, and contact information at the top of the form.

03

Provide the date of the original transaction for which the receipt is lost.

04

Detail the purpose of the expenditure, including any relevant information about the items or services purchased.

05

Include any transaction amounts or expected costs related to the lost receipt.

06

Sign and date the memo to certify the information is accurate.

07

Submit the completed memo to your department’s financial officer or an appropriate administrative office.

Who needs Humboldt State University Lost Receipt Memo?

01

Students or staff who have lost a receipt for a transaction that requires reimbursement or documentation.

02

Individuals preparing financial reports that require supporting documentation for expenses.

03

Anyone needing to account for missing receipts as part of their financial compliance procedures.

Fill

missing receipt affidavit

: Try Risk Free

People Also Ask about lost receipt

Do I need a donation receipt for tax deduction?

1. Legal requirements: The IRS requires donation receipts in certain situations. Failure to send a receipt can result in a penalty of $10 per contribution, up to $5,000 for each specific campaign.

What is donor acknowledgment?

A donation acknowledgment letter (sometimes called a donation receipt or thank-you letter) is an email or paper that recognizes a charitable contribution. At a bare minimum, it's a confirmation receipt to your donors acknowledging you've received their donation.

What is a donor receipt?

Donation receipts, or donation tax receipts, provide official documentation of a gift made by a donor. Often written in the form of an acknowledgment letter, they let the donor know that their donation has been received and allow the nonprofit to express its gratitude.

Why is donor acknowledgement important?

Why is donor recognition important? When donors don't feel like their gifts are appreciated or meaningful, they'll be less likely to give again. Fortifying your donor recognition practices will help your nonprofit cultivate stronger connections with supporters and increase your donor retention rate.

What is a common donation amount?

What is the Average Donation for Each Income Range? Income Range (Adjusted Gross Income)Average Charitable Donation$50,000 to $99,999$3,296$100,000 to $199,999$4,245$200,000 to $249,999$5,472$250,000 or more$21,2643 more rows • Feb 10, 2023

How much should I put on a donation receipt?

Donors are responsible for obtaining a written acknowledgment from a charity for any single contribution of $250 or more before the donors can claim a charitable contribution on their federal income tax returns.

What is a safe amount to claim for charitable donations?

Your deduction for charitable contributions generally can't be more than 60% of your AGI, but in some cases 20%, 30%, or 50% limits may apply.

How do you write a receipt for in-kind donations?

In-kind donation receipts should include the donor's name, the description of the gift, and the date the gift was received. Cash donation receipt. A cash donation receipt provides written documentation of a cash gift.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my generic lost receipt form directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your no receipt form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I get lost receipt form dts?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the missing receipt image. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for signing my printable lost receipt form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your lost receipt form template right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is Humboldt State University Lost Receipt Memo?

The Humboldt State University Lost Receipt Memo is a form used to document and report a lost receipt for expenses incurred, allowing individuals to account for expenditures without the original receipt.

Who is required to file Humboldt State University Lost Receipt Memo?

All students, faculty, and staff who need to account for expenses but cannot provide the original receipt are required to file the Humboldt State University Lost Receipt Memo.

How to fill out Humboldt State University Lost Receipt Memo?

To fill out the Humboldt State University Lost Receipt Memo, complete the form with your name, department, date of the expense, transaction details, the reason for the loss of the receipt, and any other required information.

What is the purpose of Humboldt State University Lost Receipt Memo?

The purpose of the Humboldt State University Lost Receipt Memo is to provide an official way to document and explain the absence of a receipt for expense reimbursement or accounting purposes.

What information must be reported on Humboldt State University Lost Receipt Memo?

The information that must be reported on the Humboldt State University Lost Receipt Memo includes the date of the expense, amount, description of the item or service purchased, justification for the loss, and your signature.

Fill out your Humboldt State University Lost Receipt Memo online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Organization Claim Receipt is not the form you're looking for?Search for another form here.

Keywords relevant to claim receipt need

Related to lost receipt template

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.